Last week Business / Arts released a much-anticipated study for cultural participation in Canada. CultureTrack: Canada was produced by Business / Arts, LaPlaca Cohen and Nanos Research. The American version of this study has a slick website and year over year data, so it’s interesting to now have the inaugural edition of the Canadian version available.

Last week Business / Arts released a much-anticipated study for cultural participation in Canada. CultureTrack: Canada was produced by Business / Arts, LaPlaca Cohen and Nanos Research. The American version of this study has a slick website and year over year data, so it’s interesting to now have the inaugural edition of the Canadian version available.

Making “data-driven decisions” is something that every organization seems to be talking about at the strategic planning table. With the incredible amount of analytics and data that can be mined from patron databases, social media and email analytics, online questionnaires and many more options, it is essential for arts organizations to be aspiring to use their data to make better decisions.

How overwhelming. I have never met a researcher or statistician employed at an arts organization, and the knowledge required to be able to translate research into action can be a real challenge. So, after reviewing the CultureTrack: Canada report, I still have a lot of questions, and also was wondering how arts organizations and professionals will be using this research in their work. Here are my top observations and recommendations from the lens of an arts marketer.

Just because it’s culture, doesn’t mean you are doing it

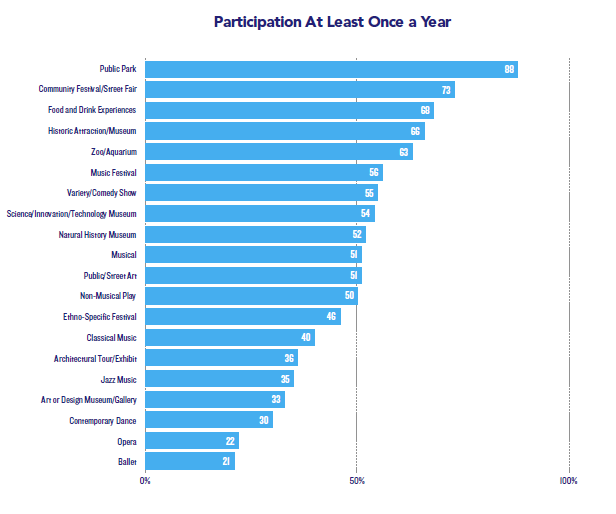

As the study reports, “Canadians are cultural omnivores. Rather than define ‘culture’ in narrow term, audiences view it as inclusive of a broad set of diverse activities…”. More than 50% of Canadians selected classical music, ballet, opera and musicals as cultural activities, but in the past 12 months, only 40% of survey respondents attended a classical music concert, 22% attended an opera and 21% attended a ballet.

What this means for marketers: Your Canadian audience are recognizing many activities and experience as cultural activities, but a small portion as actually participating in the ‘traditional’ arts. If you promote opera, ballet, jazz or classical music, how can you grow your participation? Since 88% of Canadians have visited a public park in the past year, and 73% have participated in a street fair or community festival, are your ‘traditional’ arts organizations present at those locations and experiences

The culturally active Millennial

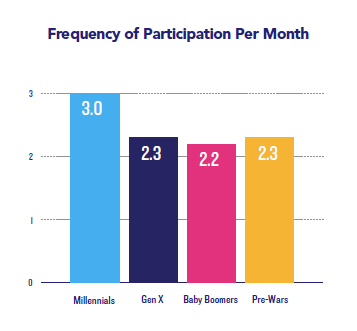

Millennials take part in approximately three cultural activities per month, and not only for the highest indexing activities.

What this means for marketers: Are you creating product and marketing messaging that speaks to millennials? If they are more active participants in culture the possibilities are ripe to attract them. Diving into more research about how millennials consume content, what marketing channels they use and how they want to spend their time is essentials for the sustainability of cultural organizations. You can read a recent article about this very topic here.

Allophones are out there

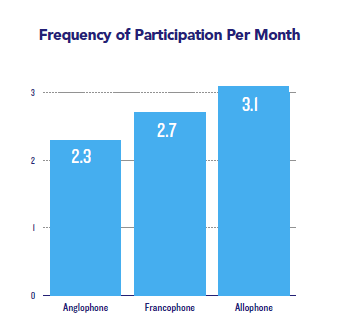

Allophones are those who speak a language at home other than English or French. Allophones participate in 3.1 cultural activities per month, compared to 2.7 activities for Francophones and 2.3 activities for Anglophones.

What this means for marketers: Are you presenting programming and marketing materials that are of interest to allophones? If you live in the GTA, Caucasians are now the visible minority. Not only do you need to understand the geographic community in which you work, but the cultural community as well. The more product that you can present that is of interest to Allophones of a variety of ages, and if you can create messaging that appeals to them, there is potential for audience growth. As the population in Canada continues to be more diverse, this will become a requirement to stay relevant.

We just wanna have fun

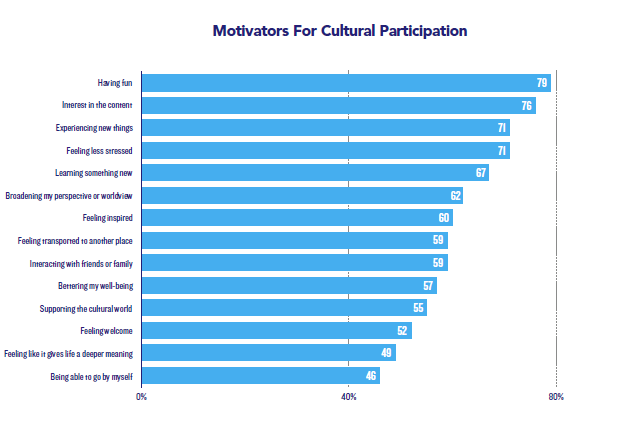

Are you surprised to see that the number one reason Canadians participate in cultural activities is to have fun. This is closely followed by interest in the content, experiencing new things and feeling less stressed.

What this means for marketers: How are you communicating your cultural activity to your potential audience? Do you promote it as a serious experience or show the entertaining side of your product? If you are asking your consumer to take a risk and experience something new, you need to ensure that they can feel comfortable with the proposition and connect with the activity with the outcome that they will be interested and maybe have fun. How do people access your product? Sometimes just buying a ticket or finding parking can be stressful. If your consumer wants to feel less stressed can you enhance their customer journey to encourage relaxation or escape?

My social life

The three top characteristics for an ideal cultural activity were identified as “social, lively and interactive’. The top three barriers to cultural participation were indicated as “it’s not for someone like me” “the cost is too high”, and “location is too far”. If we look back to those activities that have the most participation – visiting a public park, attending a community festival or street fair, food and drink experiences, and attending a historic attraction or museum – this makes sense. For example, community festivals or street fairs are located in neighbourhoods, which could be close to one’s home and free or low cost to attend. These festivals are often ways for people to connect and certainly have an element of fun.

What this means for marketers: If you are promoting cultural activities that have lower participation, there are opportunities to connect with more people. Can you offer programming in parks or at community festivals, and offer free or low-cost experiences? Can you create options that combine food and drink or design ways to encourage patrons who want to come alone to meet up with other ‘singles’ and have a chance for a lively, social experience? How can you encourage participation in the cultural experience?

I have too many questions about the “Tech Lag” results to comment here, but certainly the high level data suggests that arts organizations are behind on using digital tools throughout the customer journey.

Some of my overall questions about the survey that I hope will be answered:

- Why is there such a significant number of unemployed respondents compared to the national average?

- Why was the survey conducted over the December holidays period (December 21, 2017 to January 11, 2018). Could this have affected the response from those who celebrate Christmas, Chanukah or other holidays?

- The commitment / loyalty question – is it confusing to list commitment to a bank or airline vs. commitment to a cultural organization? I don’t know if having points on a credit card and not wanting to lose them is the same as choosing to be a supporter or subscriber to an arts org. They seem different.

- How would online search be used as part of a cultural activity? Would that be in the research phase of deciding to participate and wanting more information, or actually using online search as part of the activity?

- Print consumption – how is perceived behaviour of what is the catalyst for participation measured against actual behaviour? For example, we often have customers tell us they heard about our ad in the newspaper but we don’t put ads in the newspaper. Can this really be a correlation? Print is virtually non-existent in some markets.

- Ads have been split up into traditional, content and digital ads. But do people really know what motivates them to purchase? How is brand awareness and CTA able to be measured subjectively?

- Is there a correlation between the lack of participation in digital cultural offerings the past year and the lack of options that are presented by cultural organizations?

Why this matters:

Culture Track: Canada is the first study of its kind in the country and will be a baseline for systemic, policy, funding and programmatic development in the cultural sector. Read the study; ask questions; share the findings with your staff, board, donors, patrons and other stakeholders; and figure out how you can ensure your marketing efforts are speaking to the right person on the right channel.